I not only understand finances, I'm also passionate about them. And I want to see people improve. Over the years I've helped my colleagues track their expenses, negotiate better interest rates, pay off their credit cards, get life insurance, and even buy homes. It's also highly likely that the credit card in someone's wallet is the one that I specifically recommended for them.

— Daniela, Group Account Director

Personal Finance 101

Recently, colleagues in our Montreal office voiced a desire for financial education. (No one in Toronto ever said such a thing because that's basically what I do every single day). So I developed a curriculum and presentation in collaboration with our Director of Finance. It was easily the most attended and engaged lunch-and-learn in company history. Here is some of the material I preach regularly.

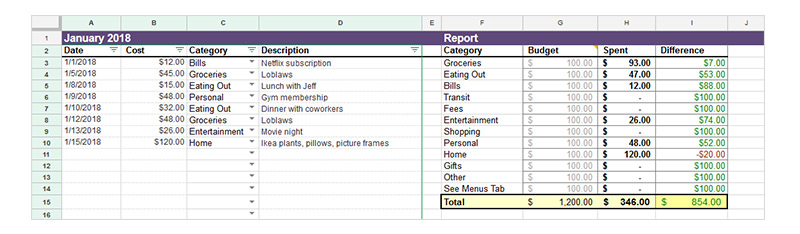

You can't manage what you don't measure

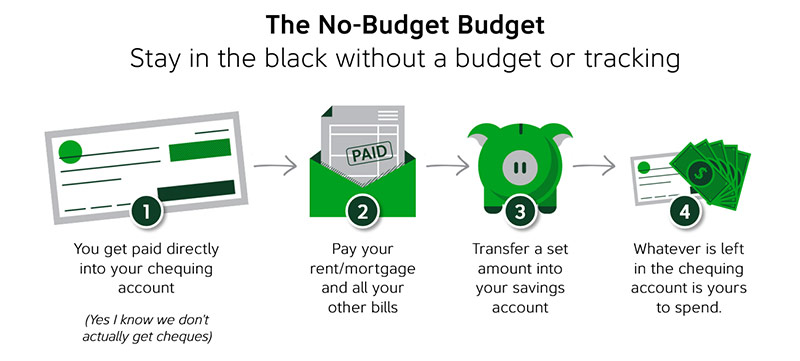

Understanding where you're spending your money is so critical. You can certainly use apps like Mint or TD's MySpend but I prefer to have absolute control over the data so I built my own spreadsheet. Download it from Google Sheets if you want to take it for a spin.

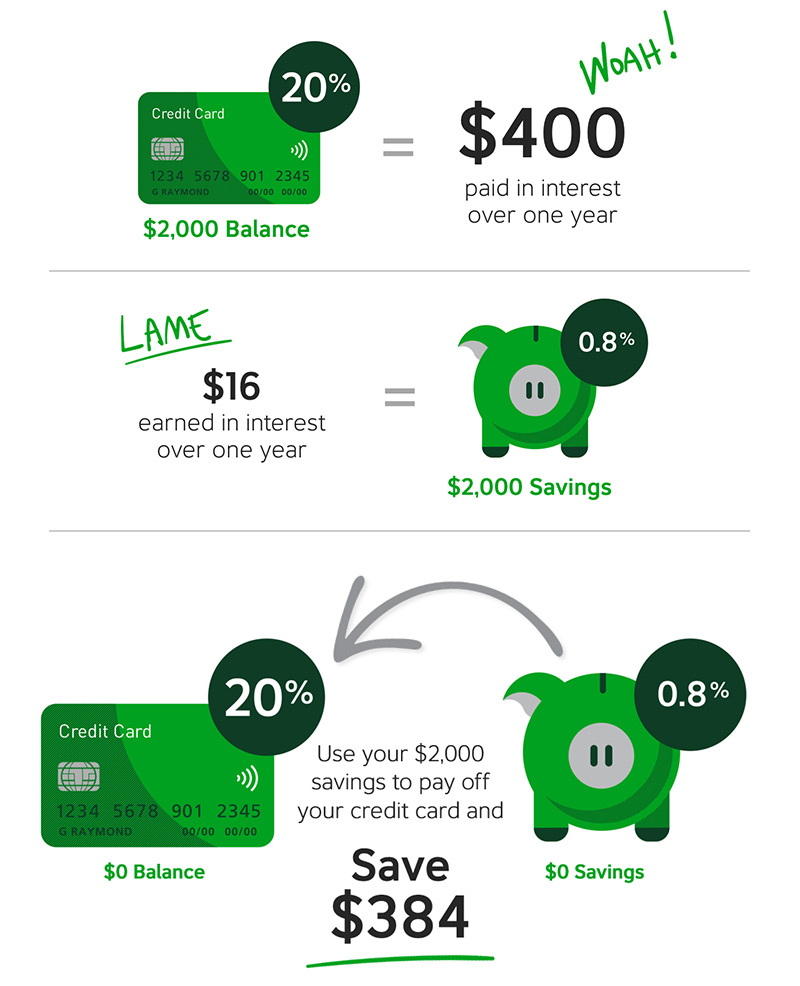

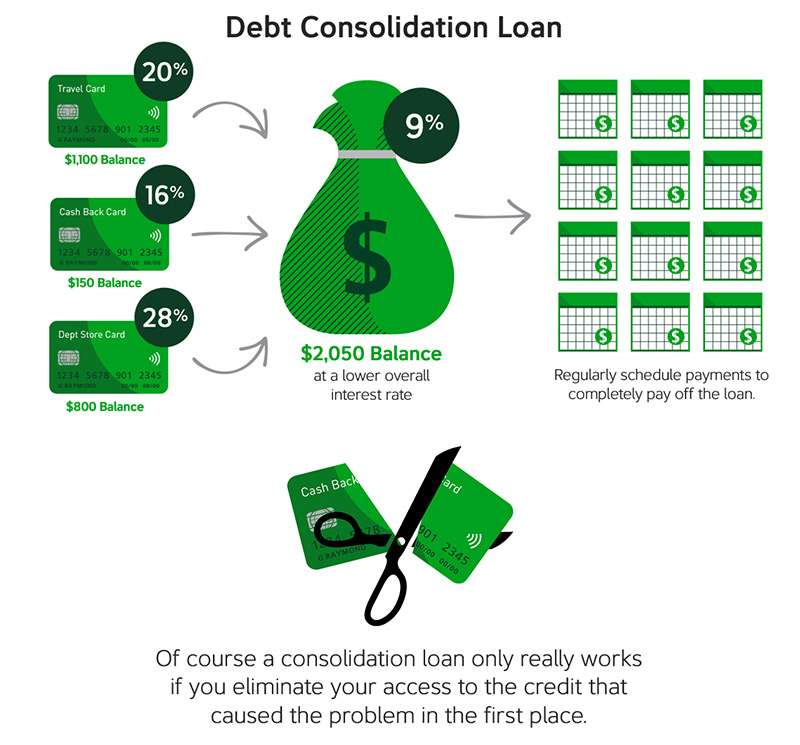

I hate credit card debt

It brings me such joy when I can find ways for people to eliminate their credit card debts altogether.

All the acronyms

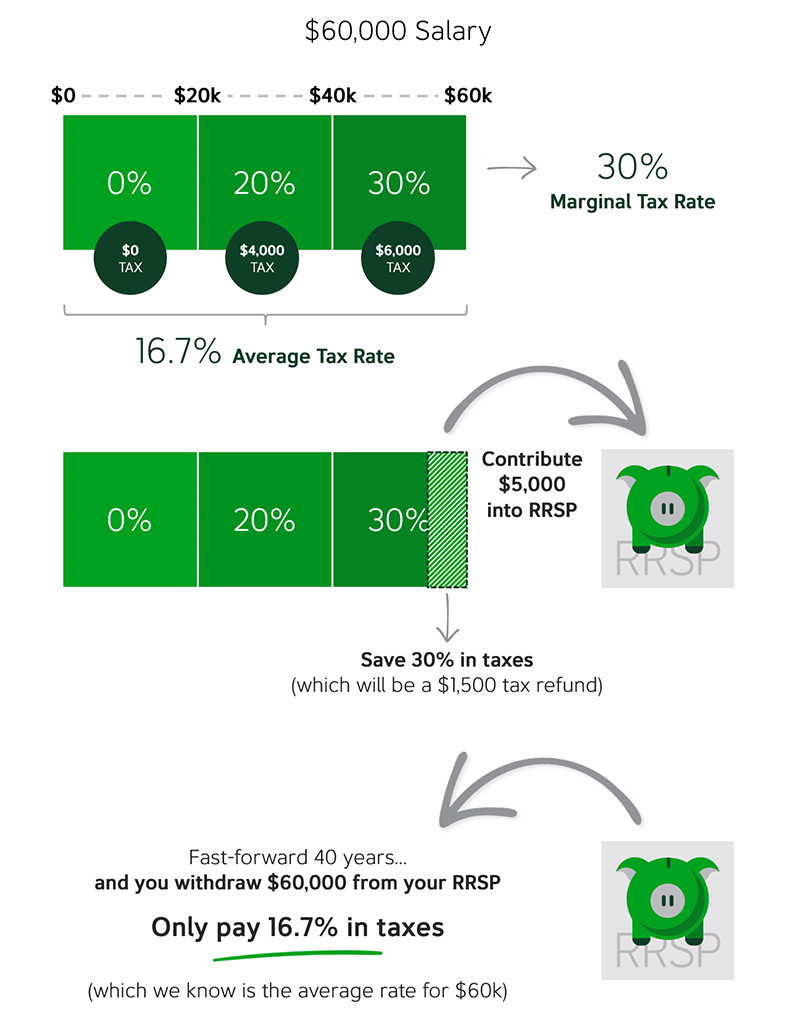

Most people find RRSPs confusing. Basically no one understands TFSAs. I help people understand both accounts and where they should be saving their money.